The Gold Yield MarketplaceTM

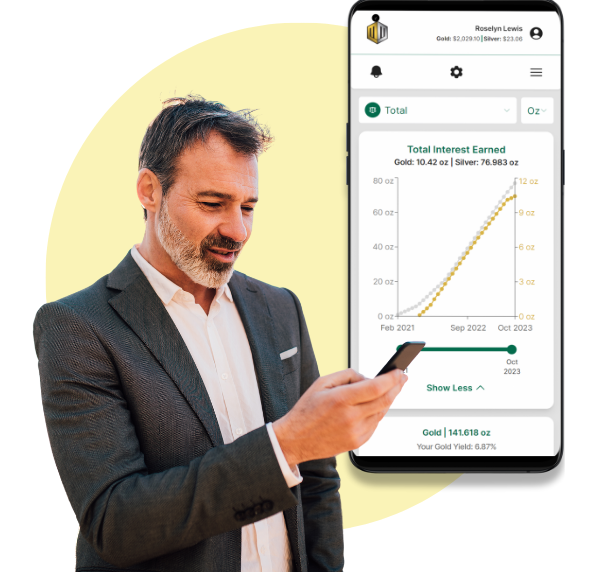

Monetary Metals is a marketplace platform for individuals and institutions to earn a yield on their gold, paid in gold, by making it available it to qualified companies who need gold financing.

Gold yield

Earn 2-5% annually on your gold by putting in to work at carefully-vetted businesses. Accredited investors can enjoy even higher yields in our gold bond offerings.

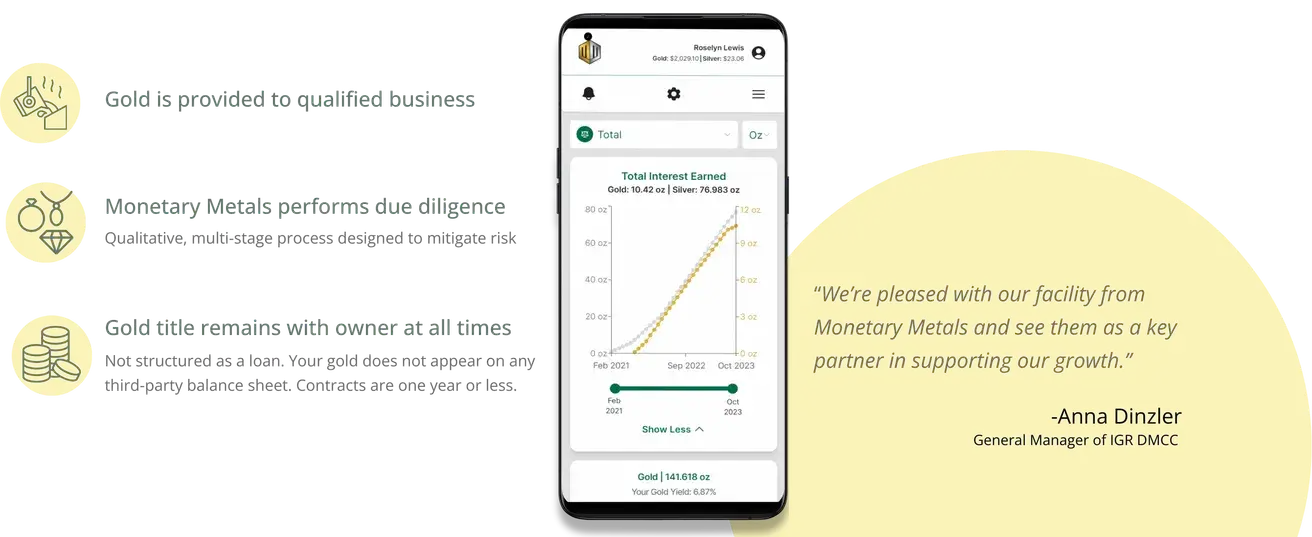

Gold financing

We are a premier capital provider to qualified companies seeking $5M to $30M in precious metals financing. Our solutions are tailored to your business.

Why Monetary Metals

Yield-bearing gold storage

Stop paying fees. Start earning a yield.

Expert team

Expert team

Decades of experience from the best and brightest in the industry.

Proven track record

Proven track record

Results speak for themselves. 74 funded deals, zero losses.

Gold Yield

Earn rental income on your gold.

Monetary Metals offers investors the ability to put their gold to work by deploying it to qualified companies in the precious metals industry. Companies get competitive financing for gold inventory or work-in-progress, without the need to hedge.

Why work with Monetary Metals?

Earn monthly income on gold you own, without any storage or insurance fees

Your deployed metals are fully insured and monitored 24/7 by Monetary Metals

Your gold remains in physical form and title always remains with you

Opt-out of any opportunities you don’t want to participate in, without penalty

Partner with us

The opportunity is measured in millions of ounces. Monetary Metals brand is our most valuable asset. Our standard is institutional grade and we seek qualified partners with the same standard. Please get in touch with us if you’re interested beginning a conversation.

How it works

Advisors and fund managers can increase wallet share and revenue

Select the program that’s right for you

- Referral partner

- Aggregator partner

- Co-branding

Earn immediate revenue on new gold deposits

- Via insured transfer of existing physical metal

- Or through a new purchase of metal

Earn ongoing revenue in gold yield contracts

- Clients select which gold yield contracts they want

- Partners earn ongoing revenue as a percentage of gold deployed in gold yield contracts

- Consolidated accounting and reporting via secure client portal

74

Funded transactions across five continents

3.27%

The weighted average return in gold of all active leases, annualized1

6.70%

The weighted average return in gold across all active leases and bonds, annualized2

1Individual returns will vary, depending on opt-out selections. This number represents the annualized net return on gold to clients invested in all available leases. There are risks to leasing your precious metals, and all quoted rates are subject to lessee, and sublessee performance. Past performance is no guarantee of future results.

2Individual returns will vary, depending on opt-out selections. This number represents the annualized net return in gold to clients invested in all available leases and bonds on the platform. Due to the nature of bonds, part of this return calculation is unrealized. There are risks to leasing and loaning your precious metals, and all returns are subject to lessee, sublessee, and borrower performance. Past performance is no guarantee of future results.

3Our estimate is based on data from the World Gold Council.

4Based on the historical 10-year performance of all asset classes from May 2024. “Monetary Metals” assumes an annual rate of 3.14% on gold (the weighted average return of all leases at the time of calculation). “Gold in storage” assumes an annual storage rate of 0.50%.